Annuity mortgage

An annuity mortgage is one of the most common mortgage types. But what does it actually involve?

Annuity mortgage

An annuity mortgage is a common Dutch home loan in which you pay the same gross monthly amount throughout the entire term. This amount includes both interest and repayment, and the mortgage is fully repaid by the end of the term.

How an annuity mortgage works

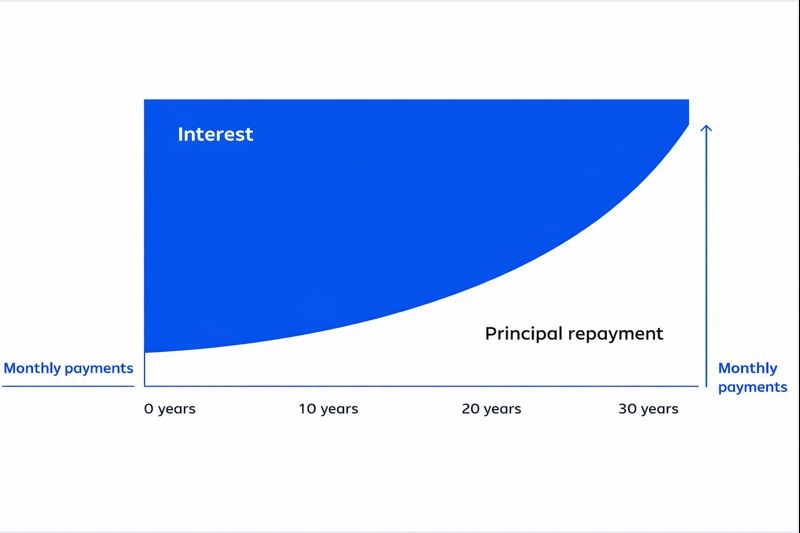

In the early years, most of your monthly payment consists of interest, while only a small portion goes towards repayment. Over time, this gradually changes: repayment increases and interest decreases, while the total monthly payment stays the same.

Tax implications for expats

In the Netherlands, mortgage interest is generally tax-deductible. As the interest portion of your payment decreases over time, the net monthly costs of an annuity mortgage slowly increase. This is an important consideration for expats who may be unfamiliar with the Dutch tax system.

Dutch mortgage rules since 2013

Since 2013, Dutch mortgage regulations require new mortgages to be repaid on at least an annuity basis in order to qualify for mortgage interest tax relief. This rule has made the annuity mortgage one of the most widely used mortgage types in the Netherlands.

Monthly payments over time

The graph above shows how monthly payments develop with an annuity mortgage. At the start, interest makes up the largest part of the monthly payment. Over time, repayment gradually increases while interest decreases.

As a result, the amount of mortgage interest you can deduct from your taxable income also declines. Despite this, the annuity mortgage remains the most popular mortgage type in the Netherlands.

Why many buyers choose an annuity mortgage

Annuity mortgages often have relatively low monthly payments in the early years compared to a linear mortgage. This makes them especially attractive for first-time buyers, expats, and homeowners who expect their income to grow over time.

Benefits

• Relatively low monthly payments at the start, due to mortgage interest tax relief

• A simple and transparent mortgage structure

• Fully repaid after 30 years

Drawbacks

• Net monthly costs increase over time

• In the early years, only a small part of the loan is repaid while interest payments are relatively high

• Overall, this is a relatively expensive mortgage type

No-obligation introductory meeting

CONTACT

Do you have a question? Please contact us, we're happy to help!