Linear Mortgage

When it comes to mortgages, the linear mortgage is a commonly used term. But what does this type of mortgage actually mean? Below, you’ll find a clear explanation of how it works and why some people choose a linear mortgage.

The linear mortage

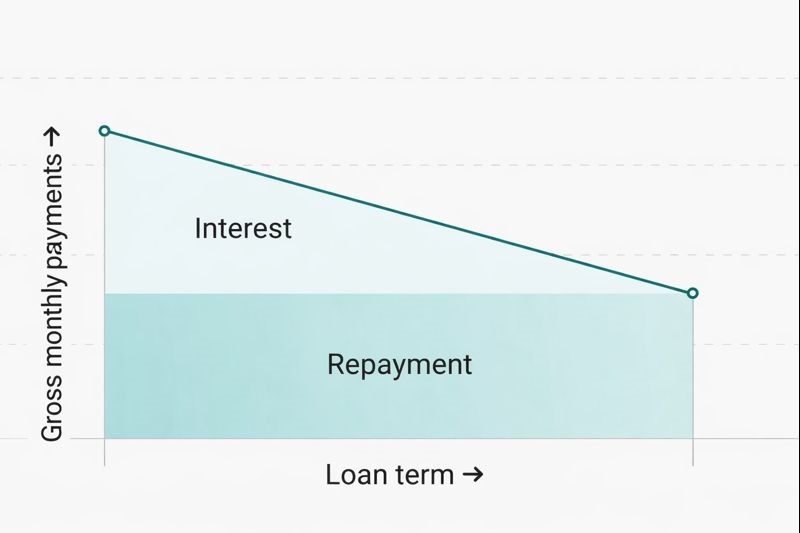

A linear mortgage is a clear and transparent mortgage type commonly used in the Netherlands, including by expats. With this mortgage, you repay a fixed amount of the loan each month, plus interest on the remaining balance.

How a linear mortgage works

Because the outstanding loan is highest at the start, monthly payments are relatively high in the early years. As the loan balance decreases over time, you pay less interest and your monthly payments gradually go down.

Why expats choose a linear mortgage

This mortgage structure offers added security. Even if interest rates rise later on, the impact is usually limited because your remaining debt is already lower. For expats who value clarity, faster repayment and lower long-term interest costs, a linear mortgage can be an attractive option.

Benefits

• Monthly mortgage payments gradually decrease over time

• A fixed and equal repayment of the loan each month

• Lower total interest costs compared to an annuity mortgage

• Fully repaid by the end of the mortgage term

Drawbacks

• Higher monthly payments in the early years

• Less suitable if your income is limited at the start, which can be relevant for some expats

• Tax benefits decrease over time as interest payments go down

No-obligation introductory meeting

CONTACT

Do you have a question? Please contact us, we're happy to help!